Yesterday, there were some great signals to enter the market. Let's have a look at the 5-minute chart and see what happened there. In my morning review, I mentioned the level of 1.2351 as a possible entry point. A breakthrough through the mark without the downward test produced no signal. In the afternoon, after a sharp rise to 1.2442, a false breakout at this mark produced an excellent sell signal. As a result, the pair fell by more than 50 pips.

For long positions on GBP/USD:

There are no UK reports today, so we can expect traders to start working off the good news on the agreement to raise the US debt limit and bears will take profits, which will lead to a further upward correction. It is unlikely for Bank of England's ILC member Catherine L. Mann to say anything new, so her speech will not have much effect on the GBP/USD pair's direction.

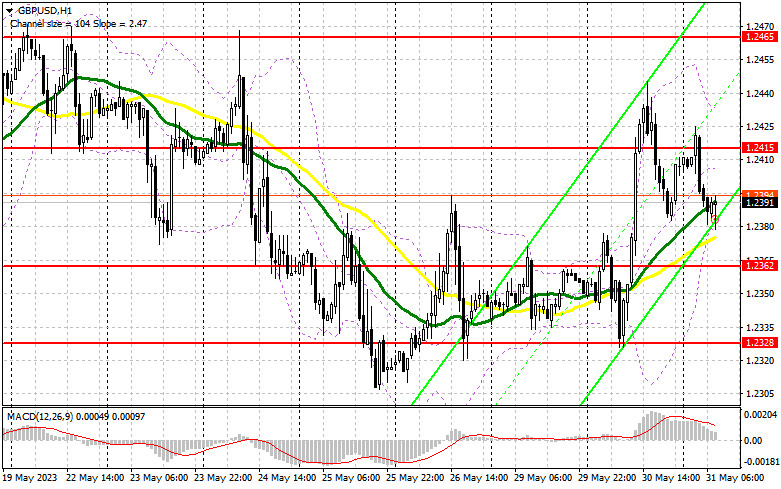

I will consider buying only after a decline and if traders manage to protect an important support at 1.2362, above which the moving averages playing on the bulls' side pass. A false breakout on that mark will produce a buy signal, targeting 1.2415, a new resistance level, which was formed yesterday. A breakout and consolidation above this range will produce another buy signal and push the pair to 1.2465. The most distant target stands at 1.2506, where I will lock in profit.

If GBP/USD declines and there are no bulls at 1.2362, the bearish sentiment will persist. In that case, the bulls' last hope will be protecting yesterday's low at 1.2328, but only after a false breakout. I will buy GBP/USD on a rebound from 1.2275, allowing a correction of 30-35 pips intraday.

For short positions on GBP/USD:

Yesterday, the bulls struck quite a powerful blow to the bears' stop-orders after news about UK inflation remaining at a rather high level. Therefore, I would expect new sellers to appear around the new resistance level of 1.2415. A failed consolidation above that range will produce a sell signal, and the pair could fall to 1.2362, an important support level, which can change the balance of forces. A breakout and an upside retest of this range will create a sell entry point with the target at 1.2328. The most distant target stands at 1.2275, where I will lock in profit.

If GBP/USD goes up and there is no bearish activity at 1.2415, it is better to hold back from short positions until the test of a larger resistance at 1.2465. In such a case, a false breakout through this mark will create a sell entry point. If there is no activity there either, I will sell GBP/USD at 1.2506, allowing a bearish correction of 30-35 pips intraday.

COT report:

According to the COT report for May 23, the number of long and short positions decreased. Last week, the pound was bearish. Fearing a default and a recession in the US, traders had to close positions, especially in the face of uncertainty surrounding the Bank of England's monetary policy stance. The regulator hinted at a pause in rate hikes. However, with high inflationary pressures in the UK, it seems unlikely. The COT report showed that non-commercial short positions dropped by 7,181 to 57,614, and non-commercial long positions fell by 8,185 to 69,203. The overall non-commercial net position came in at 11,059 versus 12,593 a week earlier. The weekly closing price fell to 1.2425 from 1.2495.

Indicator signals:

Moving Averages

Trading is around the 30 and 50-day moving averages, indicating that the bulls are trying to extend the correction.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair falls, the lower band of the indicator at 1.2380 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.