After a crazy few days of the market reaching a local bottom, cryptocurrency assets began to recover. Bitcoin hit $30k and Ethereum climbed above $2000. Despite this, the situation in the cryptocurrency market remains nervous and dangerous. The main focus of investors is now directed to stablecoins, which began to sag amid huge market volatility. After the fall of UST, problems began to arise for USDT, BUSD, and USDC.

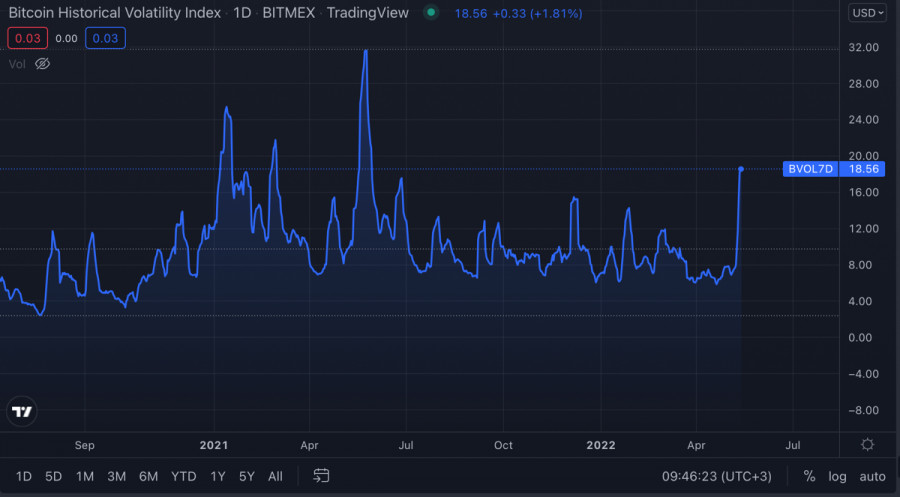

The fall of the algorithmic stablecoin to $0.16 was made possible thanks to a large drawdown of the crypto market and a record level of volatility in 6 months. Recall that before the collapse, UST was considered the third largest stablecoin in the cryptocurrency market by capitalization with a multi-billion dollar capitalization. The announcement of such a massive project as a scam caused a heated discussion among regulators around the world and primarily in the European Union. The EU Commission wants to ban stablecoins in the Commonwealth if transactions exceed $1 million per day. First of all, this proposal should secure the euro.

US Treasury Secretary Janet Yellen also spoke about the need to create and significantly tighten the legal framework for operations with stablecoins. At the same time, Yellen is confident that the volume of the crypto market has not yet reached a critical mass that can threaten financial stability. Despite this, the general message is becoming clearer, and in the near future, the cryptocurrency market and related industries will be subject to national and international control. The situation around the UST stablecoin has significantly accelerated this process. The Financial Stability Board said it was developing new rules to regulate the cryptocurrency market due to the risks digital assets pose to the financial system.

All this news indicates that the first bills on the regulation of the crypto market will be presented in the near future. With a high degree of probability, this will have a positive impact on the cryptocurrency market in the long term. The legal framework is vital to attract large investors and provide them with guarantees for the security of their activities in the digital asset market. The situation with the Luna Foundation and UST in the short term will provoke an outflow of funds from the crypto market, and the existence of a legislative framework would save the industry from even greater shocks.

In the short term, a negative reaction can be expected due to the fact that the collapse of the UST was the main trigger for the start of the regulatory process. From this, we can conclude that legislators will follow the path of comprehensive regulation of the industry with further weakening of legal norms. Another negative factor will be the growing centralization of digital assets in terms of state dependence. Against the backdrop of sanctions against the Russian Federation and global geopolitical uncertainty, cryptocurrencies remained an island of freedom, which will now also be more vulnerable to sanctions.

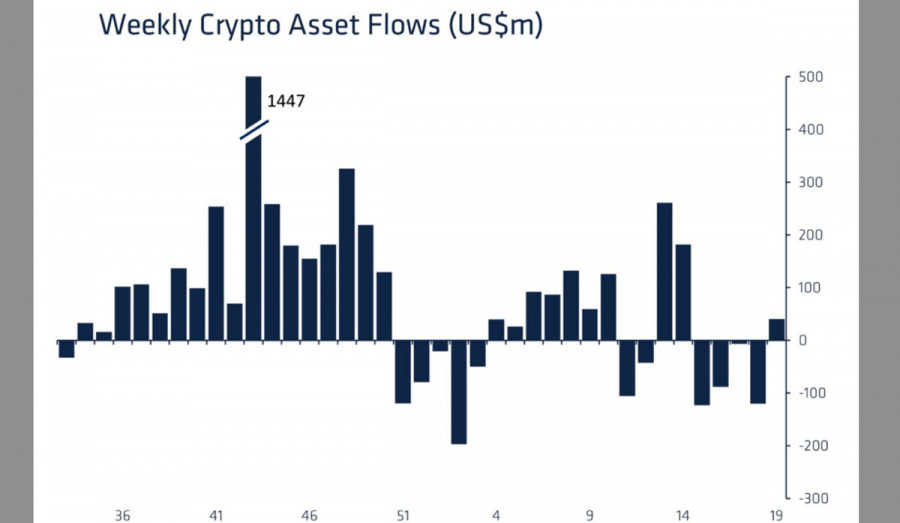

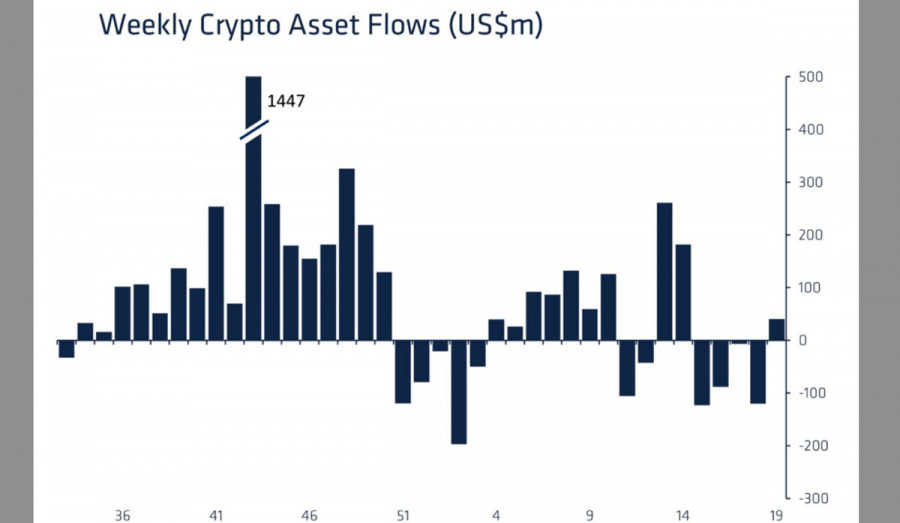

In any case, the regulation of the crypto market will take some time, and investors make transactions with coins here and now. Judging by the rebound of quotes from the $1.2 trillion mark on the graph of the total crypto market capitalization, we can conclude that the industry has survived. The key support area on the digital coin capitalization chart remained untouched, indicating a possible reversal.

Bitcoin made a local bottom at $25.2k and subsequently rebounded and recovered above $30k. Technical indicators are signaling an increase in sales: the RSI and the stochastic oscillator have reached the bullish zone, and the MACD is close to forming a bullish crossover. All these changes occur on the daily timeframe, which indicates an increase in buying activity. The cryptocurrency is trying to gain a foothold above $30k and is in the process of consolidating. If we assume that despite the volatility and the growing volumes of BTC coins on the exchanges, the asset will continue to grow, then the nearest resistance will be in the $31.3k–$35k area.

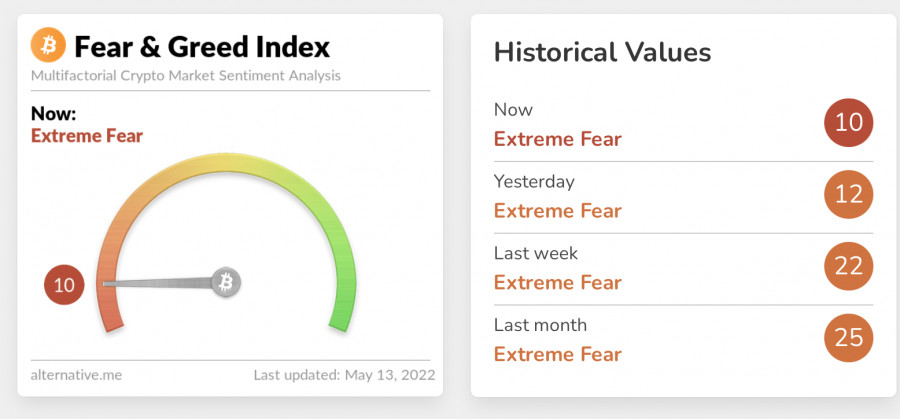

At the same time, it is important to understand that the local positive in the market is caused by the achievement of an absolute bottom of fear and panic in the market. Therefore, it is quite possible that the current growth is an upward correction. This is partly hinted at by weak buying demand during the rebound, as seen in the body of the green candle. With this in mind, it is still too early to talk about the end of the downward movement.